Thetford Town Meeting on Australian ballot again, budget approved

However, the Warning was only approved by 3 with 2 abstaining.

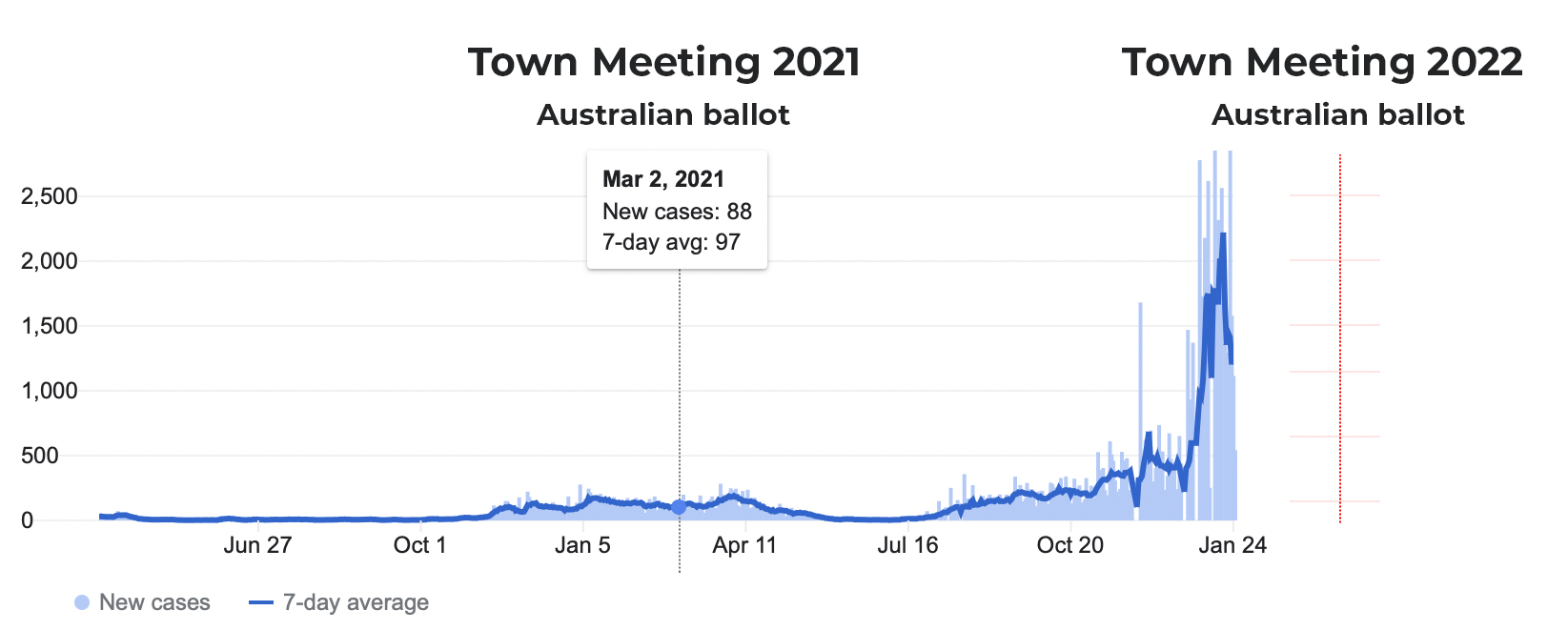

For the second year, Thetford’s Town Meeting will not take place in person. Instead, voters will be asked once again to vote on local Articles using the Australian ballot. Unlike last year, ballots will not be mailed to every voter; however, absentee ballots can still be requested. Keep an eye out for more information from the Town Clerk – the ballots are still being prepared for now.

The budget

The decision to avoid an in-person Town Meeting was unanimous among the Selectboard. However, by the end of last night’s Selectboard meeting, the Warning was only approved by 3 with 2 abstaining. The disagreement hinged on the Department of Public Works budget. The approved Article reads:

Shall the Town authorize total highway (DPW) fund expenditures for operating expenses of $1,436,763 of which $1,252,363 shall be raised by taxes with $50,000 from 2021 fund surplus and $134,400 by non-tax revenue?

“With $50,000 from 2021 fund surplus…” was the point of contention. The Department of Public Works underspent their budget this year by roughly $239,000. That surplus resulted in a fund balance of roughly $407,000. Best practices for highway department budgeting recommend that 12% to 15% of the department’s total expenditures be retained in the fund balance for unexpected expenses such as floods. In Thetford, with budgeted highway expenditures of approximately $1,437,000 in 2022, that means a healthy fund balance should be between about $172,000 and $216,000. It was at $168,000 going into 2021 after surplus was used to pay off loans and bolster the Paving Fund.

This year, the $229,000 surplus isn’t being used to pay down debts or increase our available capital for road repair, it’s being (partially) applied to the tax rate, artificially lowering this year’s increase by approximately 1.6%. Previous year surplus acts like non-tax revenue when used this way in that it reduces the amount of taxes that need to be raised. But only in year one. In year two, it becomes a liability: if that same $50,000 is not applied to the budget again, the taxpayer’s burden has to increase by $50,000 just to break even. It means the Town has to commit $50,000 in surplus every year going forward or increase the tax rate to compensate.

Inflating the budget and then using surplus to buy down the tax rate has been a common practice in Thetford. In fact, by 2019, $155,000 was being used to buy down the tax rate each year. That took a turn with new leadership in 2020 when the liability was decreased to $30,000 and then $0 in 2021.

In the weeds

In the 2022 approved budget, before non-tax revenue, the Department of Public Works budget is increasing just under 2%. However, this is primarily due to the Route 132 bond payment. There are noticeable cuts:

- No Public Works Director, instead the Town Manager will continue to perform this role. However, there is a budget for a fifth road crew member.

- Reduced budget for winter road supplies (sand and salt).

- Reduced budget for contracted services, potentially putting a larger burden on our road crew.

The contribution to the Town Tree Fund was restored to level funding after being cut in an earlier proposed budget.

As for the General Fund (everything that isn’t related to roads), the budget is increasing 6.79% before non-tax revenue and 7.42% in total. The notable increases are:

- Legal Services, up $5,000 from $25,000 to $30,000.

- Employee-related costs, such as Cost of Living Adjustments; new hires such as Zoning/Listers Clerk; and expanded hours at the Transfer Station and Treasure Island.

- Police Department, increasing almost 10%, although no new union contract has been negotiated yet.

- County Tax (up 13.57%) and Upper Valley Ambulance (up 14.22%).

Decreasing in the General Fund budget:

- Health insurance benefits paid to non-police union employees. Health insurance benefits are not decreasing for police union members after a grievance was settled.

- Funds contributed to the Town Hall Capital Fund are being cut by 50% (the Selectboard hasn’t made a decision yet on updating Town Hall’s HVAC, windows, etc.).

The town-wide road assessment that was originally intended to be completed before the end of budget season is still pending. However, the Town’s auditor did move the roughly $40,000 expense from the General Fund’s Planning and Consulting Fund to the Highway Fund’s Better Roads Fund, which is money set aside for making road grant matches.

In total, the municipal tax rate is projected to increase just over 3% after the 1.6% previous year surplus has been applied. This compares to 1.49% in 2021 when $30,000 in surplus was absorbed, 4.34% in 2020 when $125,000 in surplus was absorbed, and $3.93% in 2019 when $155,000 in surplus was applied to lower the tax rate. The budget is up 13.33% from 5 years ago, with an average 3.81% increase per year.