The 2021 tax rate, explained

Property taxes change every year, and typically they go up.

Property taxes change every year, and typically they go up. From 2015 to 2016, for example, the municipal tax rate went up 15.46%. On August 9th, the Selectboard approved the 2021 municipal tax rate at an increase of 1.37% over 2020's rate.

This is how municipal property bills are calculated: $317,950 (a typical home value in Thetford) x 1% x 0.822258 (the 2021 municipal tax rate) = $2,615.39 due in municipal taxes.

There are two things that determine the municipal tax rate: how much money the Town is expecting to raise from taxes (a product of its annual Budget), and the total taxable value of property in town that it can raise it from.

In Vermont, the total taxable value of all the property in a town is called its Grand List, and it fluctuates every year. For any given property, taxable value can decrease if it is not well maintained, encumbered with a deed restriction such as a conservation easement, or enrolled in Vermont's Use Value Appraisal (Current Use) program. In general, however, a property's taxable value tends to increase due to market forces, or because of renovation, new construction, or when a property is subdivided.

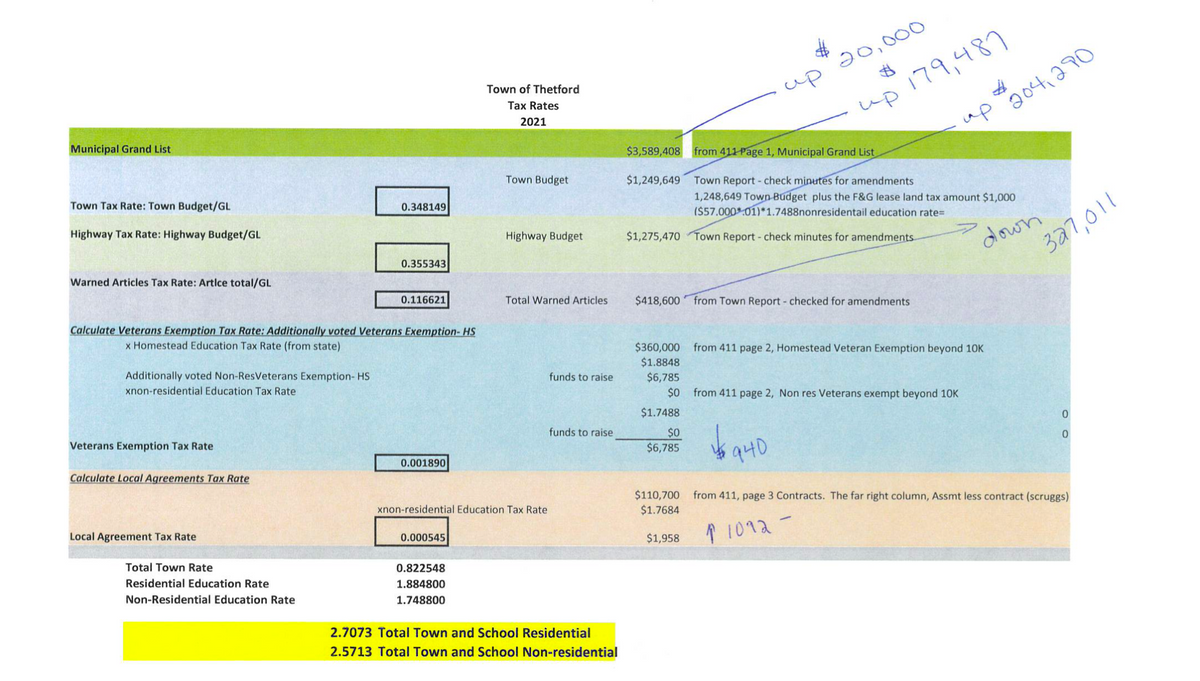

This is how the tax rate is calculated: $2,952,462 (what the Town is expecting to raise from taxes in 2021) divided by $3,589,408 (the 2021 Grand List) = 0.822548 (2021 municipal tax rate)

When the Grand List increases, the tax rate decreases. In fact, the Grand List almost always increases, except, for example, in years with a high number of new Current Use enrollments. Even with an increase in the Grand List however, property tax bills can increase if the assessed value of the property increases or, more likely, if the amount the Town expects to raise from taxes increases.

How much the Town expects to raise from taxes depends on how much it expects to spend and on non-tax revenue. If the Town expects to spend $1 million but raise $100,000 from non-tax revenue, then it only needs to raise $900,000 from property taxes. Some non-tax revenues are easier to predict that others. For example, the Town's income from Treasure Island receipts is difficult to predict, especially in a pandemic, whereas state highway aid is virtually the same every year since it is calculated from the total mileage and Class of municipal roads. The Town receives a variety of non-tax revenue: zoning permit fees, traffic tickets written by the police, Payment In Lieu of Taxes (PILOT) revenue (which is what the State pays the Town to compensate for the tax-exempt State Garage by the highway), and Hold Harmless revenues (which the State pays the Town to compensate for decreased tax revenue from properties enrolled in Current Use), to name a few.

In sum, the municipal tax rate is the Town's anticipated spending minus all anticipated non-tax revenue divided by the total taxable value of all property in town. There are a few other factors, such as Veteran's exemptions and other local agreements or an applied previous year surplus, but the basic concept is the same.

There are three ways to mitigate tax rate increases: limit new spending, increase non-tax revenues, or increase the Grand List. Year to year, the Selectboard's impact on the municipal tax rate is limited primarily to short-term spending-related decisions. However, opportunities to impact the municipal tax rate over time can be made through long-term efforts, such as improvements to Treasure Island, that could increase non-tax revenues, or long-term economic investment that could increase the Grand List.

The education tax rate is more complicated. Like the Town, the School has a budget (up only 0.563% this year at $9,001,705), but it doesn't (usually) have non-tax revenue. Therefore, the School expects to raise from taxes the full sum that it expects to spend. Unlike the Town, the School gets most of its tax revenue from the state. Most of the education taxes paid by property owners are sent to the state and then re-distributed. Only $291,082 in local property tax revenue is being paid directly to the school in FY2021/22.

The state uses an equalized education spending formula to collect and disperse money to school districts. The most important number in that formula is something called the equalized pupil number, which in Thetford is 443.01 in 2021, down slightly from last year. This number is derived from the number of enrolled students, but it is more than just that. Students are weighted based on critieria such as student need and grade. For example a pre-kindergarden student has a different weight than a middle or high school student or a student in a special needs program or living below the poverty line. The equalized pupil number is, therefore, both the number and type of students in the district.

This is how per pupil spending is calculated: $8,710,622 (the school budget minus local tax revenue paid directly to the school) divided by 443.01 (equalized pupils) = $19,662 (per pupil spending)

The School divides its budget by its equalized pupil number to get its equalized spending per pupil. If it's too high — which in Thetford it is not —the school district is penalized. The per-pupil spending is then divided by the property yield and multipled by the homestead tax rate to determine the local education tax rate. The property yield and homestead tax rate are set by the legislature each year for the entire state, as are the non-homestead rates. (Homestead is "the principal dwelling and parcel of land surrounding the dwelling, owned and occupied by the resident as the person's domicile." Non-homestead properties include businesses and non-owner-occupied dwellings.)

This is how the homestead education tax rate is calculated: $19,662 (equalized spending per pupil) divided by $11,317 (state property yield) x $1.00 (state homestead tax rate) = 1.7374 (homestead education tax rate)

When calculating the education tax rate for income-eligible residents, a state income yield and income rate are used instead, but the formula is the same. A household that is eligible to pay taxes based on income will receive a credit on their property tax bill for the amount that their education property taxes exceed a set percent of their household income.

Another important number in the calculation is the Town's Common Level of Appraisal (CLA), which is the result of an annual Equalization Sutdy performed by the state: "The equalization study compares the ratio of the grand list listed value to the sale price for all the arms-length sales in the town over the prior three-year period."

Put another way, it is the difference between what the Town says the taxable value of its properties are, and what the market says. The 2021 CLA for Thetford is 92.18%, meaning that the Thetford's Grand List represents 92.18% of its market value. If the CLA drops below 85%, the Town is required by statute to conduct a town-wide reassessment. Thetford's education tax rate would decrease if the CLA increased – if the Grand List value more accurately represented the market value. Yet to the homeowner, a reduced homestead education tax rate would in theory be offset by an increase in their assessed property value – the homeowner would be paying fewer taxes on more value. The purpose of the CLA adjustment is to ensure each town is paying into the state education fund according to the market value of their propertoes rather than what the local Board of Listers has determined.

This is how the CLA adjustment is calculated: 1.7374 (estimated homestead tax rate) divided by 0.9218 (the CLA) = 1.8848 (adjusted 2021 homestead education tax rate)

This is how homestead education property bills are calculated: $317,950 (a typical home value in Thetford) x 1% x 1.8848 (the 2021 adjusted homestead education tax rate) = $5992.72 due in homestead education taxes (assuming no adjustments for income).

Only a small portion of revenue in the state education fund is from homestead property taxes. All of Vermont's sales tax is deposited into the State's education fund, representing roughly 28% of fund revenue. Non-homestead tax revenue is responsible for approximately 40% of fund revenue.

Since per-pupil spending determines the education tax rate, the School Board has little-to-no direct control over property tax rates. A decrease in school spending could mean an increase in the tax rate, or an increase in school spending could mean a decrease in the tax rate. And it could change the next year.

The most effective way to decrease the education tax rate without increasing assessed values is by increasing student enrollment. More students would increase the equalized pupil number and decrease per pupil spending. If more enrollment comes from more housing, it's possible that the Grand List could increase as well, which would lead to decreases in both the municipal and education tax rates.

It is possible that more housing and student enrollment could lead to a need for more public spending, however, which could increase taxes. This cycle of increasing taxes and increasing population is where local and regional planning commissions come in, exploring questions such as how much and what kind of development is appropriate.

This, in sum, is the cycle of local government (and property tax rates).