Is it time for an assessor?

There are funds available for a town-wide reassessment without necessarily increasing the municipal budget.

The Board of Listers is losing its two most experienced members, Janet Stowell and Diane Osgood, both of whom are retiring. That leaves Thetford with one Lister, Sean Boyce, and two open seats for the 2022 March elections.

Collectively, the three listers have been budgeted for forty hours a week: Janet and Diane at 15 hours each, while Sean is budgeted to work 10. What we've seen recently, as the Town has tried to fill the combined positions of Zoning Administrator and Lister's Clerk that equal only a part-time position, is little interest in part-time work. One candidate, according to the Town Manager, withdrew after learning that the part-time position(s) did not come with health benefits, of essential interest in a pandemic.

Will the voters be able to fill two part-time lister positions, or is it time for an assessor?

Time could be of the essence as Thetford is ripe for a town-wide reassessment of all its properties. The Board of Listers usually contracts part of such a reassessment, at least for commercial properties, but the kind of contractors who do this work could be booked two or three years out.

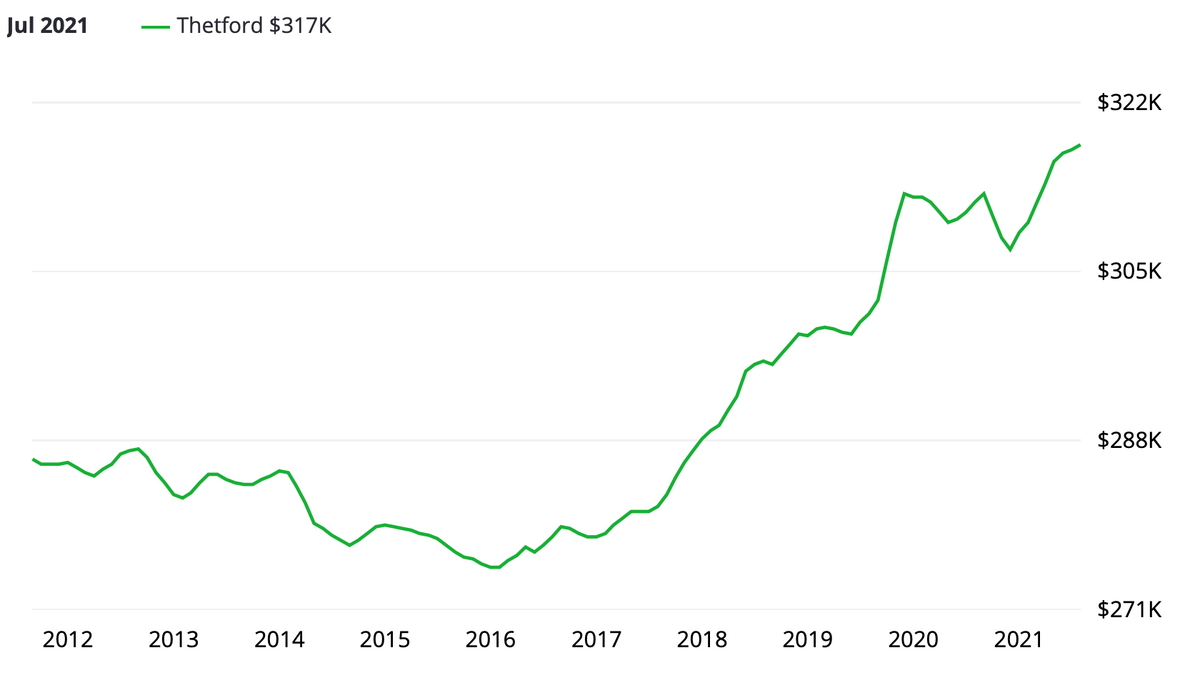

The town-wide reassessment is important. It brings the assessed values of properties in town more in line with their market values. The difference between these two values — assessed and market — is called the Common Level of Appraisal (CLA), and it has a dramatic impact on local education tax rates. The current CLA is 92.18%, meaning that Thetford's assessed values represent 92.18% of its market values. A one-percent drop in the CLA would result in a roughly 1% increase in the education tax rate, regardless of changes to school spending.

The CLA drops when market values increase, as measured by arms-length sales over the preceding three years. Important to note, however, is that the current CLA is using a three-year window that ends April of 2020, before the pandemic-related real estate boom in the Upper Valley. This means it's possible that next year's CLA, which will include data from April 2020 to April 2021, will reflect a sharp increase in the market value of Thetford's properties, driving the CLA down.

In contrast, if the CLA were to increase due to a town-wide reassessment, local education tax rates would decrease, again regardless of school spending.

The Department of Taxes notes that "Beginning with Act 60 in 1997, the administrative duties of assessing officials have become much more complex and time-consuming."

Many municipalities have moved toward hiring professional assessors to administer their grand lists because of the challenge of finding registered voters in their towns able and willing to commit to the increasing responsibilities of the job.

The Department of Taxes outlines four options:

The first option is what Thetford currently has — a Listers-only scenario: "Listers should be engaged individuals who participate in PVR-sponsored courses and the Vermont Municipal Property Assessor Certification program. Under this scenario, three or five listers are voted in for three-year terms on a staggered cycle. The listers ideally have some prior education and experience regarding real estate, construction, and computer use. Diplomacy, ethics, and discretion are also important. Being a lister is a good opportunity to learn a vital profession at any stage of life. It is the perfect position for fair-minded individuals."

Second is a Board of Listers with a contracted assessor: "In this scenario, the board of listers works regular hours doing administrative, state-mandated tasks (such as homestead filings, address changes, answering phone calls, and data entry). Assessors are hired to do valuation-related tasks, such as field work/data collection, Current Use values, valuation consulting, and reappraisal work."

In the third scenario, the assessor becomes more involved: "In this scenario, listers typically don't do the routine day-to- day tasks. Instead, lister responsibilities might include hearing and deciding grievances, making exemption determinations, and collaborating with the assessor, with no regular office hours for the board. This scenario frequently includes hiring an assistant assessor (clerk) to do routine tasks, such as processing Homestead Declarations, phone duties, public requests, etc. This scenario may appeal to taxpayers because a local board of listers remains involved in the grand list process."

The fourth option is to have no Listers at all: "This option requires that the town vote to eliminate listers and usually includes having an assistant assessor (or clerk) who does day-to-day tasks, such as processing homestead filings, providing public records, answering the phone, data input, and general office work."

There are pros and cons to each scenario. An assessor would bring professional experience and stability, but, on the other hand, might be seen as an outsider and, as a Town employee rather than an elected official, unaccountable to voters. A Board of Listers brings a depth of local knowledge and is accountable to voters, but it can be difficult to recruit and retain a full Board and there is often a steep learning curve.

The state contributes annually to a Reappraisal Capital Fund, understanding that every so often municipalities will need to underatke this monumental task to ensure their CLA reflects market values as accurately as possible. In Thetford, our Reappraisal Fund currently stands at over $112,000, meaning there are funds available for a town-wide reassessment without necessarily increasing the municipal budget.

The graph at the start of this article is from Zillow.com.